Independent insurance adviser and Broker for healthcare, medicare, life and retirement guidance

Look no Further for Insurance Guidance for Life and Health.

Integrity. Accountability. Care.

Helping You Find Your Way: The True North Journey

No matter where you are on your health or retirement insurance journey, your next step should feel clear, not overwhelming. Use our compass below to choose the path that matches your life right now—and let us guide you toward peace of mind, one smart decision at a time.

Clarity and Peace of Mind, Every Step of the Way

Life feels lighter the moment you stop struggling with confusing coverage on your own. With True North Associates guiding your Medicare and insurance decisions, these are the benefits that make your next step feel possible.

Unbiased Plan Comparison

Get recommendations based on your needs, not carrier quotas—so you can feel confident in your choice.

Guidance Tailored to Where You Live

Whether you live in Maryland, New York, or across the country, you’ll find licensed guidance tailored to your region.

Annual Reviews & Ongoing Support

Plans and needs change—so we’re here year after year to review, adjust, and keep you protected.

Solutions That Remove the Guesswork

Fee-Based Consulting

For independent, unbiased advice—even if you don’t need to buy a product—get clarity and confidence with hourly or flat-fee sessions.

Medicare Guidance

Sorting through Medicare choices is stressful—get support choosing plans, understanding enrollment, and reviewing options as your needs change.

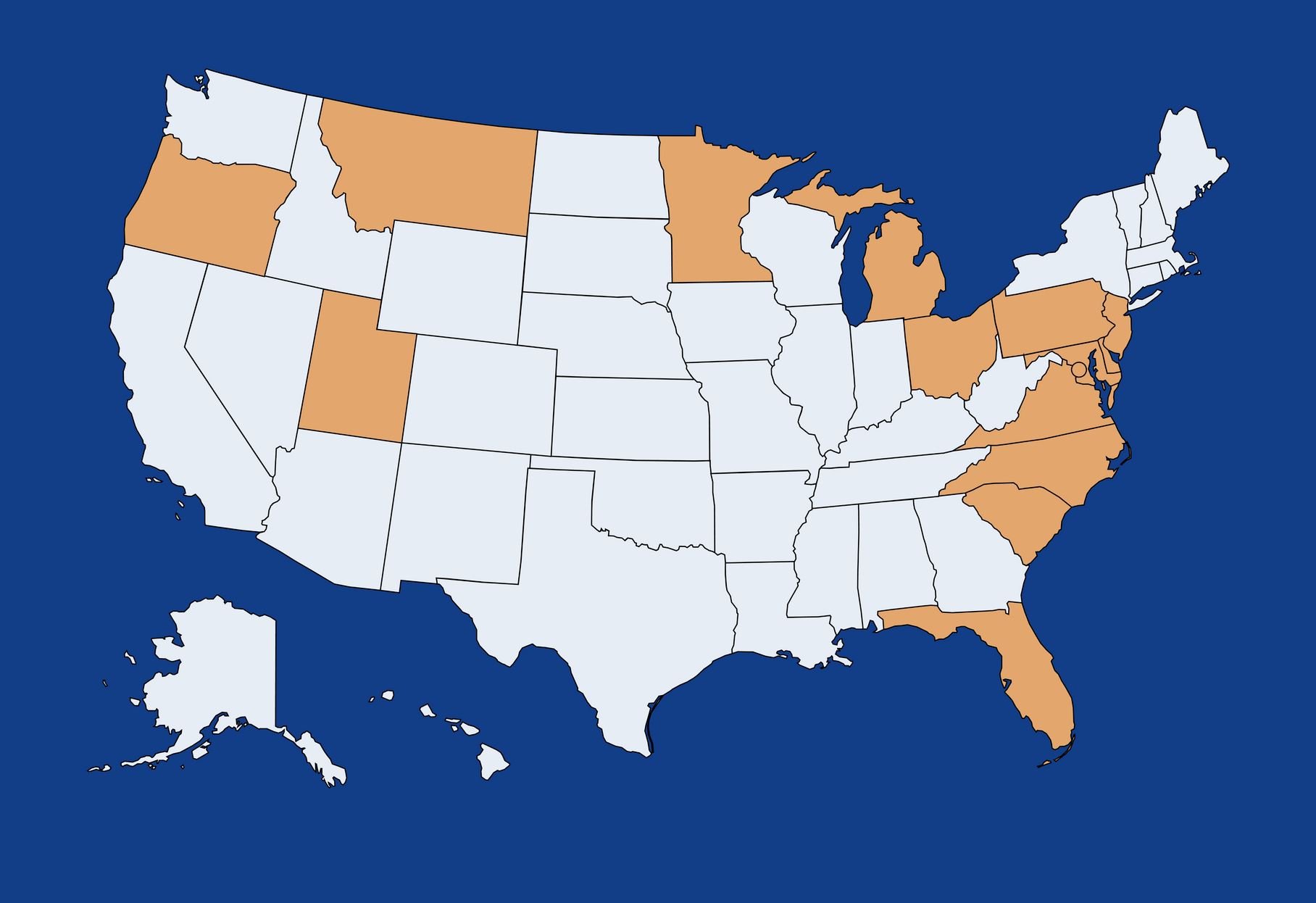

Serving Individuals & Families Across the U.S.

True North Associates is proud to call Harford County, Maryland home, while supporting individuals and families from coast to coast. Our virtual service model means you can access guidance and plan reviews from anywhere, with every state’s unique rules and benefits considered. Whether you’re comparing options for retirement, planning for long-term care, or helping a loved one understand Medicare, you’ll find guidance shaped by years of clinical and advisory experience. That’s how we deliver personal service at scale—always focused on what’s right for you.

Google Reviews

Insurance Insights

Read Our Latest Blog Article

Heart Health Myths Debunked: What Really Matters This American Heart Month

Take the First Step Toward Clarity and Confidence

It only takes one conversation to move from confusion to clarity—whether you need Medicare answers, plan comparisons, or unbiased advice for your unique situation.